Definitions

An order is an binding contract to buy or sell a certain number of shares at a certain price.

All orders have the following attributes:

- unique order number

- timestamp when the order was issued

- price

- volume (number of shares)

Once the order is placed to the marketplace, it can:

- be executed by the exchange in full or partially

- be cancelled by the participant

- be modified by the participant (the original order is cancelled and a new order is placed as a single transaction)

- remain open in the marketplace until it will be canceled at the end of the session

All outstanding (open) orders to buy or sell a certain stock constitute a book.

Some orders are not placed in the book, even though they are available for execution.

These orders are called Non-Displayed Orders and are used by market participants to hide their intentions,

as it is not impossible to track these orders before their execution.

Exchanges that handle this type of orders are called dark pools.

Nasdaq also reports the execution of non-displayed orders separately as non-diplayed trades.

There are two sides of the book: Buy-Side (all buy orders) and Sell-Side (all sell orders).

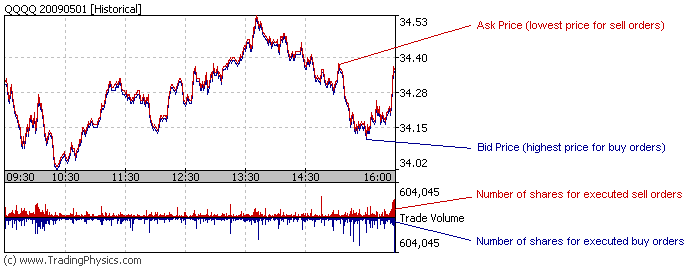

The highest price of outstanding buy orders constitutes the Bid Price.

The lowest price of outstanding sell orders constitutes the Ask Price.

Bid and Ask prices are the best deals currently available on the marketplace.

They are also called an Edge Prices for each book to stress the fact that the underlying orders are located at the very top or bottom of the list of orders sorted by price.

In a similar manner, the total volume of orders at bid or ask prices is called bid volume and ask volume correspondingly, or an edge volume.

The number of shares within a certain price range is called market depth, as they constitute the total amount of shares available for execution within the target range.

|